Call 9945689986 for more details about

LIC BIMA SHREE PLAN

Non Linked Money Back Limited Payment Guaranteed Addition

Age Group – Policy Term

8 – 55 yrs - 14 yrs

8 – 51 yrs - 16 yrs

8 – 48 yrs - 18 yrs

8 – 45 yrs - 20 yrs

Term – 4 = Premium Paying term

14 yrs – 10 yrs16 yrs – 12 yrs

18 yrs – 14 yrs

20 yrs – 16 yrs

Maturity Benefit

Maturity Sum Assured

+

Guaranteed Additions

+

Loyalty Additions

Death Benefit

Death Sum Assured

+

Guaranteed Additions

+

Loyalty Additions

Death Sum Assured

+

Guaranteed Additions

+

Loyalty Additions

Guaranteed Additions

First 5 Years

Rs.50 per 1000 BSA

Subsequent Years

Rs.55 per 1000 BSA

First 5 Years

Rs.50 per 1000 BSA

Subsequent Years

Rs.55 per 1000 BSA

Commencement of Risk

from

Day One

from

Day One

Sum Assured on Death :

Highest of:

1. 125% of BSA or

2. 10 times AP or

3. 105% of Total Premiums Paid (excluding GST)

Highest of:

1. 125% of BSA or

2. 10 times AP or

3. 105% of Total Premiums Paid (excluding GST)

USP’s of BIMA SHREE

1. Exclusive Plan for Upper Middle Class

2. Guaranteed Addition for Full PPT

3. Loan after 2 years

4. 125% Risk Cover from day 1

5. Premium Waiver for Minors

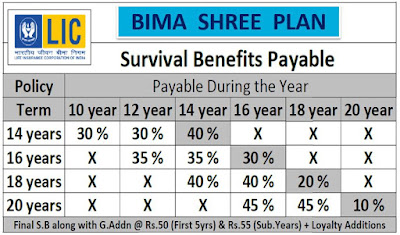

6. Money Back in 2 years Gap

7. 4 years Premium Holiday

8. Loyalty Addition after 5 years

9. SB Deferment Option

10. Settlement Option for SB and Claim

1. Exclusive Plan for Upper Middle Class

2. Guaranteed Addition for Full PPT

3. Loan after 2 years

4. 125% Risk Cover from day 1

5. Premium Waiver for Minors

6. Money Back in 2 years Gap

7. 4 years Premium Holiday

8. Loyalty Addition after 5 years

9. SB Deferment Option

10. Settlement Option for SB and Claim

Optional Riders:

1. Accidental Death and Disability Rider

2. Accident Benefit Rider

3. Term Assurance Rider

4. Critical Illness Rider5. Premium Waiver Benefit Rider (Minor)

1. Accidental Death and Disability Rider

2. Accident Benefit Rider

3. Term Assurance Rider

4. Critical Illness Rider5. Premium Waiver Benefit Rider (Minor)

Loan Just After

2 years

Vist our site for more details

www.licbangalore.co.in

Our other websites:

www.licagentbangalore.com

www.licagentbangalore.in

Comments

Post a Comment